Bank of England base rate

For an overview of. The current official Bank Rate is 075.

How The Bank Of England Set Interest Rates Economics Help

May MPC Summary and minutes and May Monetary Policy Report.

. As a tool the BOE uses the Bank of England base rate BOEBR now called the Official Bank Rate. Visit the Bank of England website for more information. If so find out what the recent change in the base rate means for you.

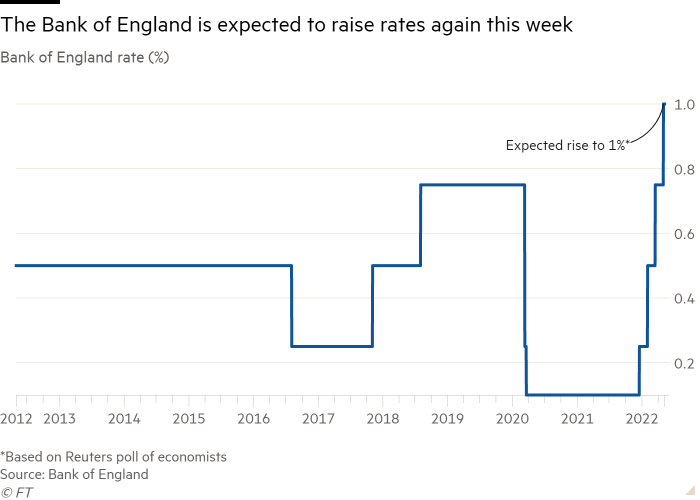

UK factories are hiking prices at a record pace as everything now cost more piling further pressure on the Bank of England. On Thursday the Bank of Englands Monetary Policy Committee is widely expected to vote to raise the base rate to one percent the highest its been since early 2009. In the MPCs central projections in the February Monetary Policy Report published before Russias invasion of Ukraine UK GDP growth was expected to slow.

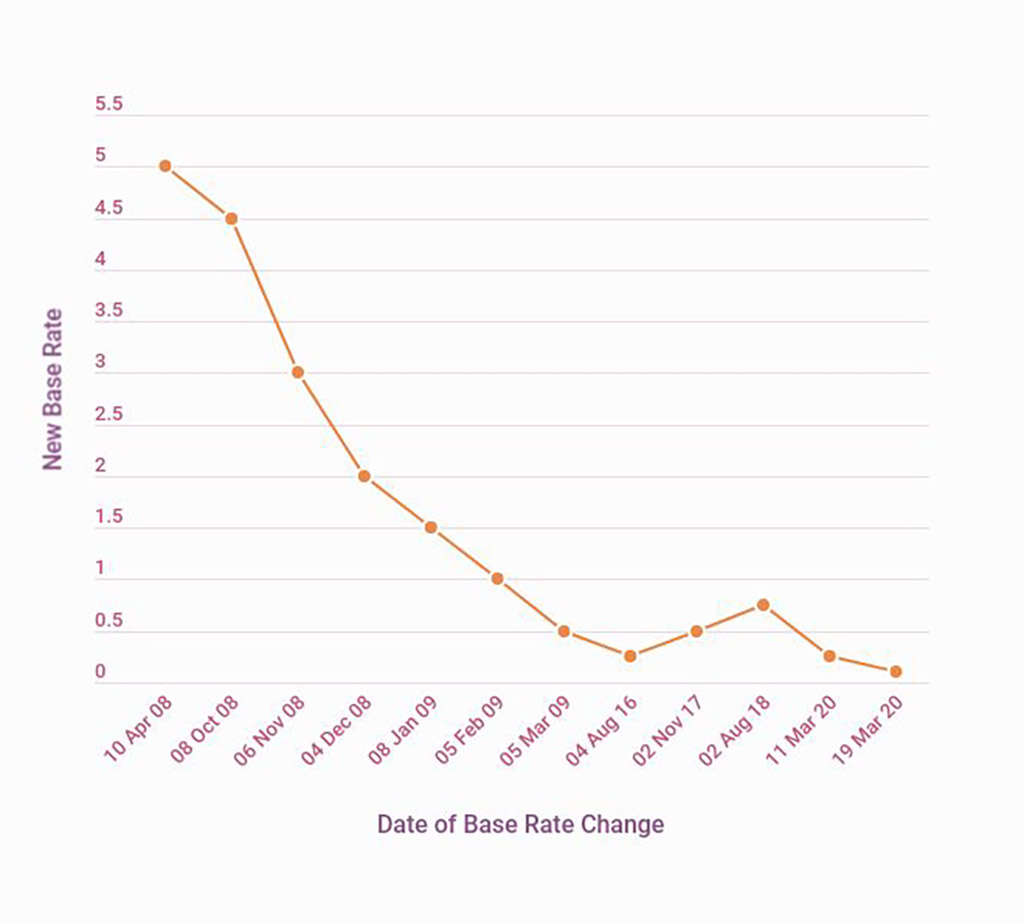

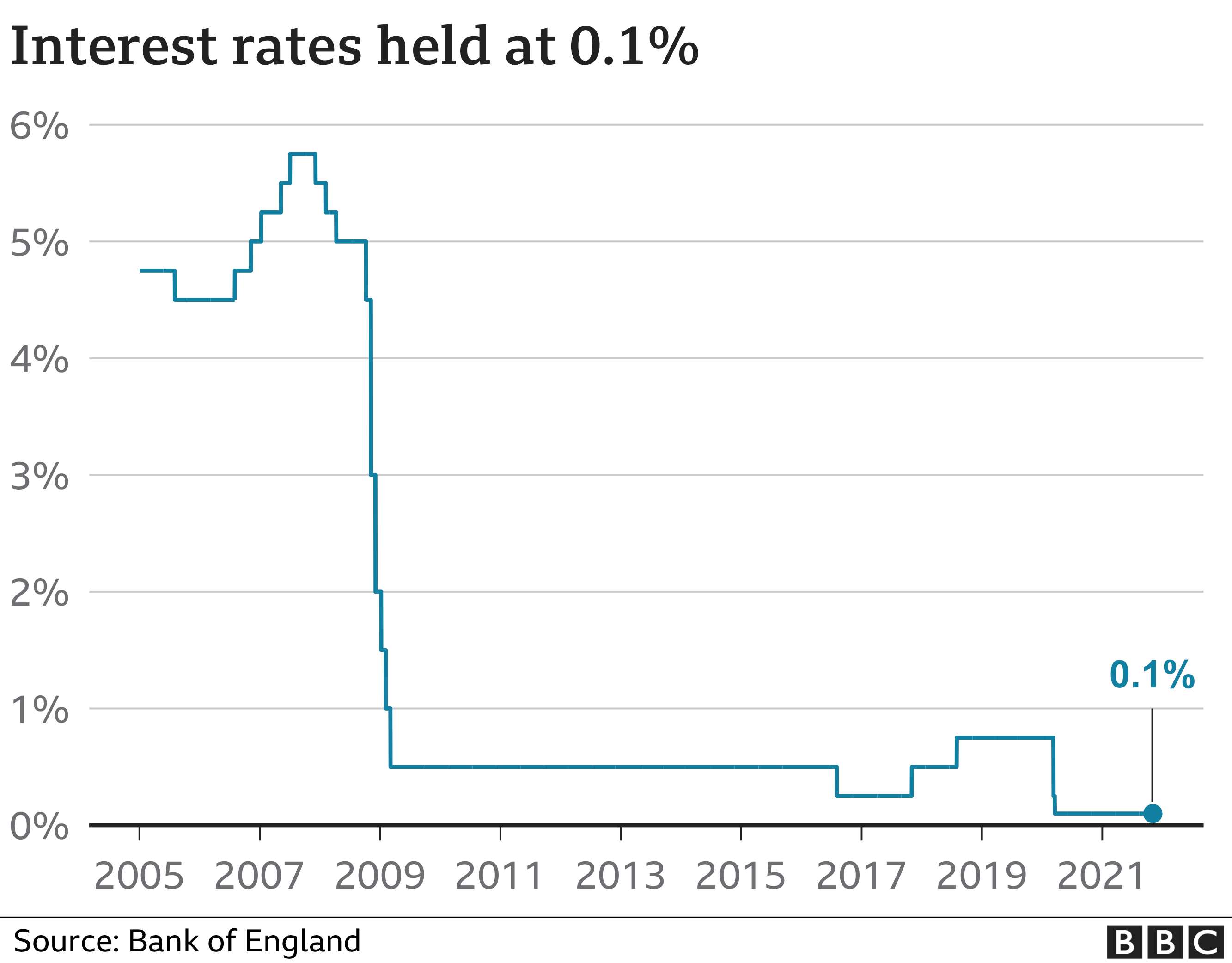

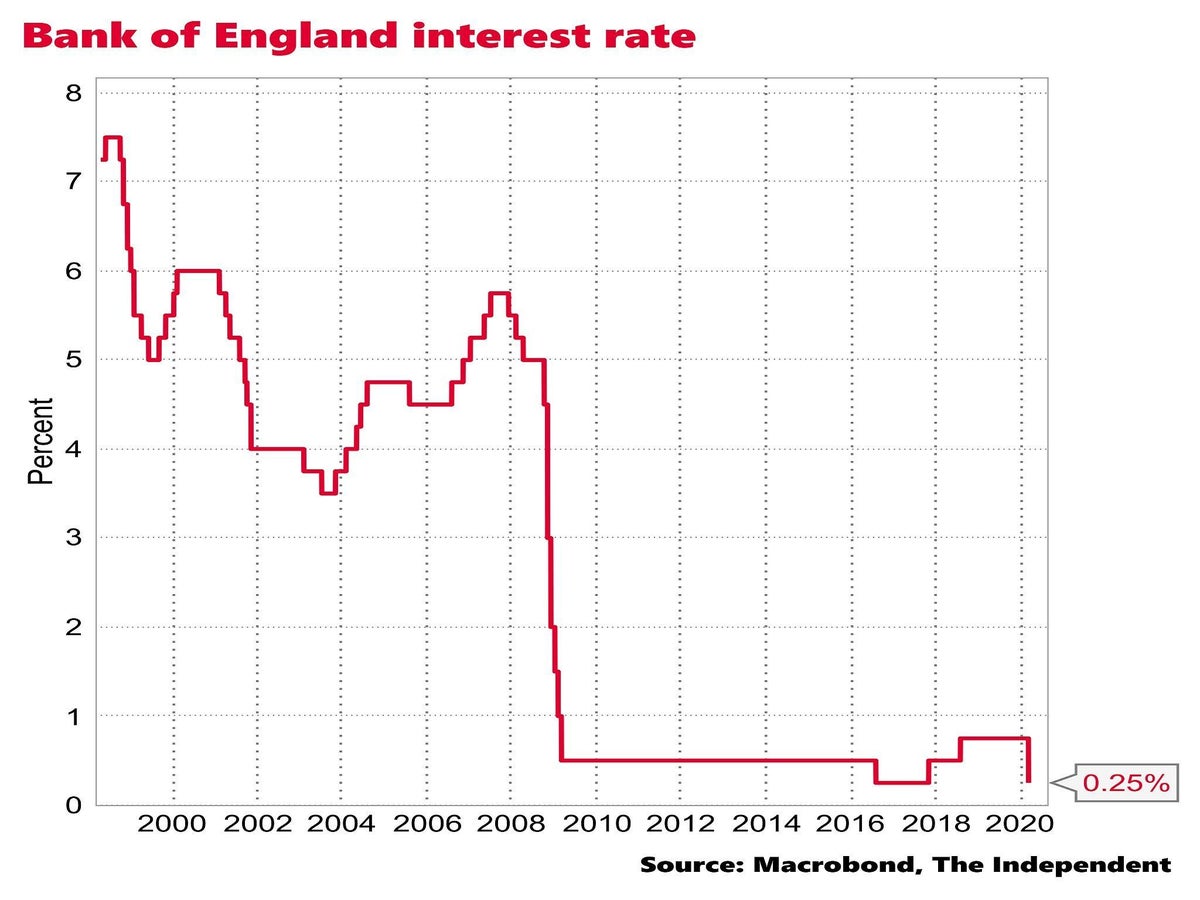

The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020. June MPC Summary and minutes. February MPC Summary and minutes and February Monetary Policy Report.

The base rate was increased from 025 to 050 on 3 February 2022 to try and control inflation. It is the British Governments key interest rate for enacting monetary policy. The BoE base rate is sometimes just known as Bank Rate.

The aim of the base rate reduction was to help control the economic impact of coronavirus on the UK economy. At its meeting ending on 16 March 2022 the MPC voted by a majority of 8-1 to increase Bank Rate by 025 percentage points to 075. The Bank of Englands Monetary Policy Committee MPC has voted by a slender majority of 5-4 to increase the base rate by 025 percentage points.

Bank of England base rate. To receive advice on the most suitable first. The base rate was previously reduced to 01 on 19 March 2020 to help control the economic shock of coronavirus.

The current base rate is 075. Bank of England hikes base rate to 05. It is more analogous to the US discount rate than to the federal funds rate.

Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability. The Bank of England Monetary Policy Committee voted on 17 March 2022 to increase the Bank of England base rate to 075 from 050. In the United Kingdom the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day.

When the BoE lowers interest rates consumers tend to increase. The Bank of England followed through with a widely anticipated interest rate hike on Thursday as it attempts to tackle soaring inflation which it. Paper 20 and 50 note withdrawal.

The Bank of England BoE base rate is often called the interest rate or Bank Rate and sets the level of interest all other banks charge. We offer a range of fixed rate mortgages that let you fix your rate and payments for a set period. Five members of the MPC voted in favour of the rise to 05 while four voted to raise rates to 075.

The MPC made the decision in response to CPI inflation rising to 54 a figure well above the Banks target of 2. Do you have savings a mortgage or a credit card with us. The Bank of England base rate is currently 075.

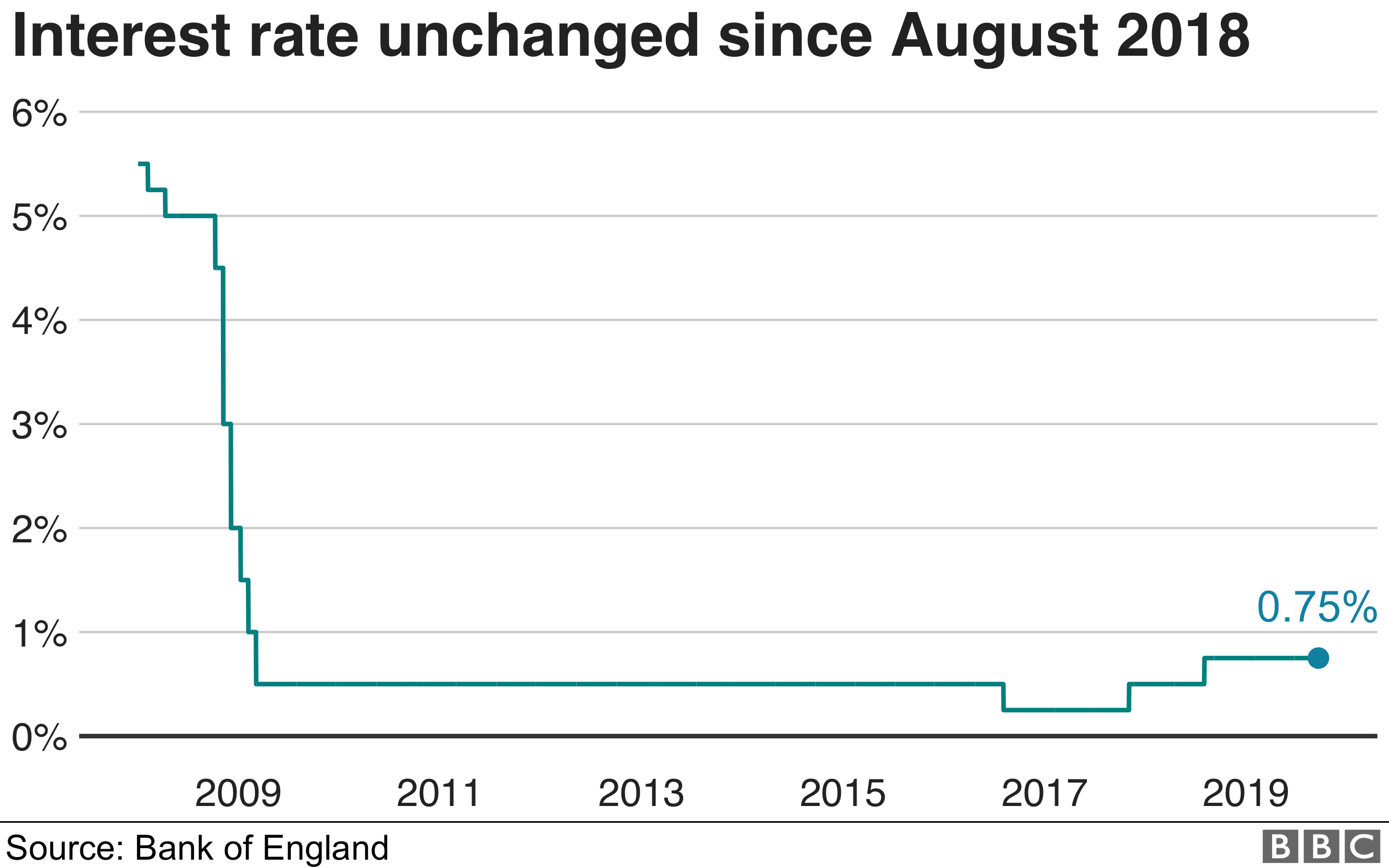

The current Bank of England base rate is 075. Since 2009 mortgage holders. The Bank Rate is set by the BoEs Monetary Policy Committee who will next meet on Thursday April 5.

The bank reduced the base rate from 075 to 025 1 week earlier on 11 March 2020. 47 rows The Bank of England base rate is the UKs most influential interest rate and its official. Such an increase would take the base rate to levels not seen since the financial crisis and pile greater borrowing costs on current holders.

It was raised to 025 in December 2021 and again to 05 in February 2022. The MPC meets eight times a year to set the. If youd like to move your mortgage to a different interest rate you have 2 options.

May 1 2022 1215 pm Updated 1216 pm Interest rates are expected to be hiked once again on Thursday to their highest level for 13 years as. A low rate of inflation results in a stable economy and preservation of the value of the inhabitants money. March MPC Summary and minutes.

HMRC interest rates are linked to the Bank of England base rate. It influences how much interest banks will charge on loans or pay out for savings. The Bank of England BoE base rate which will be reviewed on Thursday May 5 impacts high street bank interest rates.

Bank of England expected to hike rates from 075 to 1 on Thursday. The Bank of England has increased base rates to 075 from 05 after the Monetary Policy Committee MPC voted in favour of a rise. One member preferred to maintain Bank Rate at 05.

The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. Interest is a fee you pay for borrowing money and is what banks pay you for.

The Bank of England this week is expected to raise interest rates to their highest level in 13 years and clarify how it plans sell off some of. If the Bank of England base rate changes during your fixed rate period it wont affect your payments. What it means for you.

Bank Of England Base Rate Money Co Uk

Bank Of England Forecasts Low Interest Rates For Longer Bbc News

Bank Of England Hints At Future Interest Rate Rise Bbc News

Bank Of England Poised To Raise Interest Rates To Pre Covid Level Financial Times

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent